Colorado’s health insurance for small employers could jump by nearly 15% on the Western Slope

The size of employers who qualify for the small group plans will also change in 2026

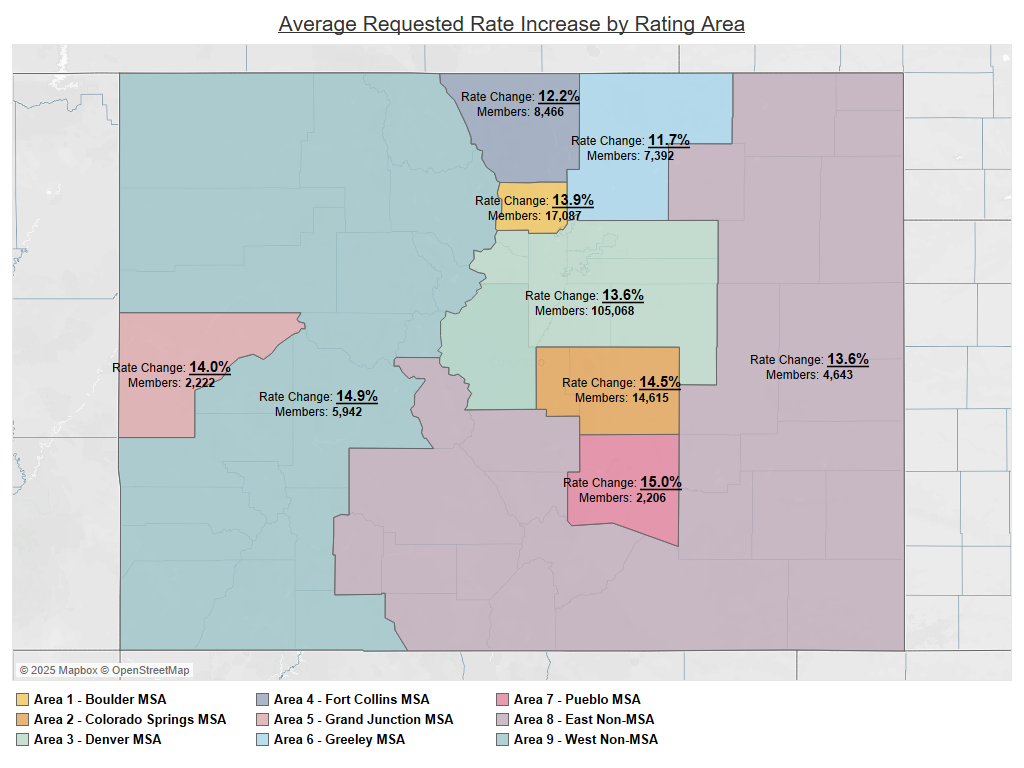

Small employers in Colorado could see health insurance premiums increase by an average of 13.6%, according to the preliminary rates requested by insurance companies. The average increase could be even higher — approaching 15% — on the majority of Colorado’s Western Slope.

“The requested premium increases for plan year 2026 will put employers in the position of making difficult decisions on how to pay for health insurance for their employees,” said Colorado Insurance Commissioner Michael Conway in a news release. “Once again, this year it will be important for employers to shop for the best option available for their employees, as there may very well be more affordable options in the market. And we will continue to work to ensure that the rates we approve are appropriate and justified.”

Five insurance companies — Anthem’s Rocky Mountain Hospital and Medical Services, Kaiser Foundation of Colorado, Kaiser Permanente, United Healthcare Insurance Co. and United Healthcare of Colorado — plan to offer 383 plans in the small group market in 2026. This is one less provider than 2025, as Anthem’s HMO Colorado is discontinuing its small group product in 2026.

The highest proposed increases come from United Healthcare Insurance Company (16.7%), United Healthcare of Colorado (15.5%) and Anthem (14.5%). The lowest proposed rate increase came from Kaiser Permanente, which had an average increase of 3.6%, and Kaiser Foundation of Colorado with a proposed 7.8% increase.

While Colorado’s small group employer group used to apply to companies with between one and 100 employees, it will only apply to those with between one and 50 in 2026, following a legislative change made in 2024. This change was estimated to bring an additional 0.8% increase in premiums, according to the Colorado Division of Insurance.

Around 172,000 Coloradans currently rely on these small group plans for health insurance, according to the Division of Insurance.

These preliminary rates could see even higher increases on Colorado’s Western Slope. In the division’s Western coverage region — which includes every Western Slope county except for Mesa County — the average premium increase is proposed at 14.9%. The only region with higher preliminary rates is Pueblo County with an average proposed increase of 15%.

The proposed increases are around half of those proposed in the individual market, which could increase by an average of 28% following changes at the federal level. The average increase in the individual market could reach 38.8% in the Division’s Western coverage region.

However, the small employer market proposal still represents a significant jump from previous years. In 2025, the average increase for the small group market was around 7%.

The division will accept public comments on the small group market through Aug. 12 and will hold a public stakeholder meeting for the proposed rates on Aug. 1, 2025.

Aspen area included in ‘release zone’ for wolverine reintroduction

The Aspen area has been included in one of three general release zones for the reintroduction of wolverines into the state, according to preliminary information from Colorado Parks and Wildlife’s developing plan.