Colorado’s Western Slope could see health insurance rates jump as high as 38% next year

The preliminary rates requested by insurers are impacted by federal changes, inaction, according to the Colorado Division of Insurance

Madison Osberger-Low/The Aspen Times

Coloradans enrolling in the state’s individual health insurance plans could see their premiums increase by an average of 28% in 2026, according to the preliminary health insurance premium rates requested by insurers. On the Western Slope, these increases could rise by over 38%.

The significant jump is spurred by “chaos” at the federal level — including the passage of Trump’s “One Big, Beautiful Bill” and Republicans’ refusal to extend federal tax credits that are set to expire this year — according to the Colorado Division of Insurance, which released the proposed rate increases on Wednesday.

“We have been warning folks that the chaos being caused by the federal government for our health insurance markets was going to create real pain for Coloradans,” said Michael Conway, Colorado’s insurance commissioner, in a news release. “These rate filings are a direct reflection of that.”

According to the division, these federal changes and impacts to affordability could lead to between 100,000 and 110,000 Coloradans losing health insurance.

All of the proposed plans and premiums requested by insurers will be available for public comment by Monday, July 21, and open for submissions until Aug. 8. The division will hold a public stakeholder meeting for the proposed rates on Aug. 1, 2025.

What are the proposed increases?

The increases will impact those who do not get health insurance coverage from an employer plan and enroll in coverage through the state marketplace, Connect for Health Colorado. In 2025, nearly 300,000 Coloradans purchased a plan through the market.

The state offers coverage through six companies: Cigna Health & Life Insurance Company, Denver Health, Anthem, Kaiser Foundation Health Plan of Colorado, Rocky Mountain HMO and SelectHealth.

Statewide, the average rate increase requested by these companies is 28.4%.

The highest proposed increase comes from Rocky Mountain with an average increase of 36.4%, followed by Anthem with 33.6% and Cigna with 29.4%. The lowest proposed increase comes from Kaiser Foundation Health Plan, which proposed an average increase of 15.3%. SelectHealth proposed an average increase of 19.3% and Denver Health, 23.4%.

The preliminary rates do not include proposals for Colorado Option plans, which were created in 2023 to create a lower-cost option for individuals. In previous years, the rate increases for these plans have been lower.

In a statement, Mannat Singh, Executive Director of the Colorado Consumer Health Initiative, said Colorado Option plans have “historically increased competition and ensured that savings can be found.”

“While it will be much, much tougher this year, it is increasingly important for Coloradans to review their options to find the most affordable plan for their needs,” Singh said.

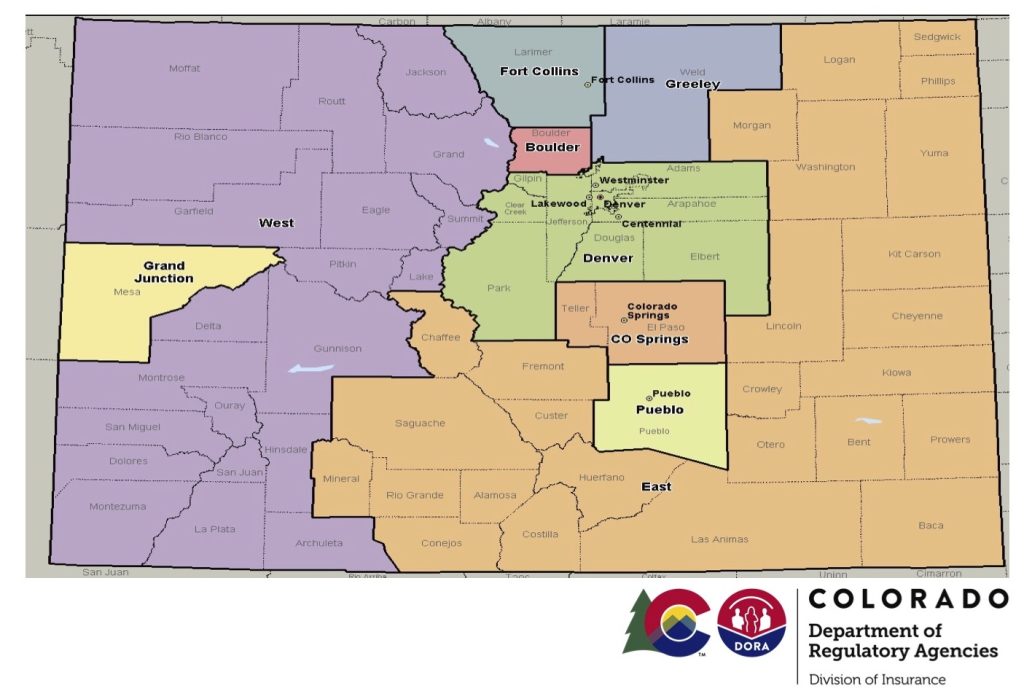

Conway noted that the mountain areas, rural counties and Western Slope will be hit the hardest.

The division’s Western coverage region — which includes every Western county except for Mesa County — has the highest average rate increase in the 2026 proposals at 38.8%. This could impact over 42,000 enrolled Coloradans. The region that includes Mesa County follows with an average increase of 38.4%.

“The sad reality is that many of those folks will be forced to gamble with their health because they simply cannot afford these rate increases caused by the federal government,” Conway said.

This sentiment was echoed in statements from Colorado’s state and federal lawmakers.

“Families in my community will struggle to afford Trump’s 40% increase in premiums, and many will be forced to make difficult choices,” said Colorado House Speaker Julie McCluskie, a Dillon Democrat. “With fewer insured patients, our rural health care systems that provide a lifeline to many folks on the Western Slope might not be able to keep the doors open.”

While Colorado has seen individual rates increase for the past four years as well, the 2026 proposal is a significant escalation of the increases. In 2025, the average statewide increase was 5.6% and 9.5% across Western Colorado (excluding Mesa County).

The average statewide increases were 9.7% in 2025, 10.4% in 2023 and 1.1% in 2022.

According to the 2023 Colorado Health Access Survey, around 5% of Coloradans statewide purchase their plan individually. Around 50% are enrolled in an employer-sponsored plan, 30% in Medicaid and 10% in Medicare. In the counties along the I-70 mountain corridor — Eagle, Garfield, Grand, Pitkin and Summit counties — closer to 9% purchase an individual plan, with 45% getting it through their employer.

These counties have historically had the highest uninsurance rates in Colorado, with an estimated 12.6% lacking any health insurance coverage. Statewide, around 4.5% of the population has no health insurance.

Losing federal assistance hits premiums hard

Colorado’s lawmakers, stakeholders and Division of Insurance blamed the loss of financial assistance and health care cuts passed in Republicans’ budget bill for these significant premium jumps.

This includes the expiration of enhanced premium tax credits offered through Affordable Care Act marketplaces. These credits — created by the American Rescue Plan and continued with the Inflation Reduction Act — will expire at the end of 2025 without action from Congress. The government has said it intends to let the expiration date pass. The division said their expiration was the “core driver” of the rate increases requested by insurers.

In 2025, the total amount returned to customers as tax credits grew by nearly 46%, reaching $972,558,880, according to Connect for Health Colorado’s 2025 report.

Colorado Democratic Sen. Michael Bennet called these tax credits a “critical lifeline” in a statement.

“If Republican leadership fails to extend the Expanded Premium Tax Credits, set to expire this year, private health insurance costs will skyrocket,” Bennet said.

The loss of the credits will cause a “subsidy cliff,” the Division of Insurance reported, where individuals making over 400% of the federal poverty level — which equates to $62,600 for a single person or $128,600 for a family of four — will no longer receive subsidies for health insurance from individual markeplaces like Connect for Health Colorado.

Colorado’s reinsurance program — passed in a 2019 bill as a way to subsidize high-cost claims for insurers and subsequently decrease premiums — will be cut by 40% in 2026 as a result of the credit’s expiration. According to the division, this drop is responsible for approximately 8% of the increase that Coloradans will experience in 2026.